Why Organisations in Germany, the Netherlands, France and the UK Are Choosing Bulgaria for Nearshore IT Recruitment

- SmartChoice

- Dec 23, 2025

- 16 min read

Introduction: The Digital Imperative and the Talent Paradox

The digital infrastructure of Western Europe is finding itself at a precipice. For Chief Technology Officers (CTOs), Human Resources Directors, and strategic decision-makers in London, Berlin, Amsterdam, and Paris, the operational mandate has never been clearer: digitise, automate, and innovate. Yet, the mechanism to achieve these goals (the recruitment of high-calibre technical talent) has never been more obstructed. We are witnessing a talent paradox where the ambition of European enterprise is limitless, but the capacity of the local labour markets to fulfil that ambition is critically constrained.

The geopolitical and economic tremors of the early 2020s have settled into a new reality characterised by demographic stagnation, spiralling wage inflation, and an increasingly complex regulatory environment. The era of easy access to local talent is over. The data emerging from the third and fourth quarters of 2024 paints a stark, undeniable picture: the talent gap in core Western markets is a structural chasm. This article posits that the solution to this crisis lies not in the traditional, often fraught, model of Asian offshoring, but in a sophisticated, culturally aligned, and fiscally efficient nearshore partnership with Southeastern Europe, specifically Bulgaria.

This comprehensive analysis serves as a strategic blueprint for organisations navigating this pivot. It is not enough to simply state that "Bulgaria is cheaper." To make an informed strategic decision, one must understand the macroeconomic pressures forcing a rethink of recruitment strategies in Western Europe. We must dissect the fiscal mechanics that make Sofia a sophisticated Centre of Excellence rather than just a cost-saving outpost. Furthermore, we will use search data to understand market intent, explore the specific technological domains driving this migration (such as ServiceNow and Agentic AI) and present a detailed, narrative-driven client story from the UK financial services sector.

By examining the specific pain points of Germany, the Netherlands, France, and the UK, and juxtaposing them with the capabilities of IT recruitment in Bulgaria facilitated by partners like SmartChoice International, we reveal why this corridor of talent has become the primary artery for digital resilience in Europe.

Part I: The Western European Talent Crisis, A Country-by-Country Analysis

To truly appreciate the value proposition of the Bulgarian nearshore model, one must first perform a forensic examination of the "push factors" originating in Western Europe. The migration of technical work is rarely a decision taken lightly; it is a response to acute systemic pressures. The following analysis utilises labour market data from 2024 and 2025 to quantify the specific pressure points in the continent's four major economies.

1. Germany, The Innovation Bottleneck of the Mittelstand

Germany remains the economic engine of Europe, yet this engine is sputtering due to a critical shortage of digital fuel. The famed Mittelstand (the small and medium-sized enterprises that form the backbone of the German economy) is struggling to digitise at the pace required to maintain global competitiveness against agile competitors from the US and Asia.

The demographic data is alarming. Germany is facing a demographic cliff as a larger number people enter retirement. This exodus is not merely a reduction in headcount; it represents a massive loss of institutional knowledge and engineering pedigree that is not being replaced by domestic graduates at an equivalent rate. Recent federal labour statistics indicate that Germany recorded over 137,000 unfilled IT and software roles entering 2025. This figure is not a projection; it is a current reality representing thousands of stalled projects, delayed product launches, and missed revenue opportunities.

The shortage is most acute in niche, high-value fields such as Artificial Intelligence (AI), robotics, and cloud infrastructure. While the German university system remains excellent, the volume of STEM graduates is insufficient to meet the explosive demand from the automotive, fintech, and industrial automation sectors. For a German automotive firm attempting to transition to software-defined vehicles, the inability to hire a Senior DevOps Engineer or an Embedded Systems Architect is an existential threat.

Further compounding the issue is the sluggish pace of recruitment. German recruitment trends for the second quarter of 2024 revealed that businesses took a deliberate average of 6.6 weeks to fill positions, a timeline that is significantly slower than their UK counterparts. It goes without saying that a delay of nearly two months per hire is operationally debilitating. It slows down the "time-to-value" for digital initiatives and allows competitors to capture market share.

However, the most significant driver pushing German firms toward nearshore solutions is the rising non-wage labour cost. Germany has long been known for its comprehensive social security system, but the costs associated with it are becoming prohibitive for scaling technical teams. By 2025, total social security contributions in Germany are projected to exceed 40% of gross wages. For an employer in Munich or Berlin, hiring a senior engineer is not just about the €80,000 base salary; it involves an additional €30,000 or more in mandatory contributions, health insurance surcharges, and administrative overheads. This "tax wedge" creates a massive financial barrier to scaling internal teams, forcing CFOs to look for alternative models that offer fiscal efficiency without compromising on quality, a search that increasingly leads to Bulgaria.

2. The Netherlands, The Capacity and Housing Ceiling

The Netherlands presents a different but equally urgent set of challenges. The Dutch economy is highly digitised and innovative, but it is hitting a hard ceiling in terms of capacity. The country consistently records the highest job vacancy rates in the European Union, reaching 4.1% in late 2024. This statistic implies that for every 100 jobs in the economy, more than four are unfilled, a staggering ratio that highlights the desperation of Dutch employers.

Historically, the Netherlands has relied on the "30% ruling", a tax advantage for highly skilled migrants that allows them to receive 30% of their salary tax-free, to attract foreign talent. This policy was a magnet for developers from across the globe. However, recent political and policy shifts have led to a gradual scaling back of this benefit, dampening the influx of non-EU expatriates just as demand is peaking. The reduced attractiveness of the Netherlands as a destination for expats has exposed the lack of domestic depth in the talent pool.

Data from hiring platforms indicates that the median time-to-hire for software engineers in the Netherlands is 32 days. While this appears faster than Germany, it masks the intensity of the competition. Approximately 43% of open roles target Mid-Senior level engineers, the precise demographic that is in shortest supply. Companies are fighting over the same small pool of senior developers in Amsterdam, Rotterdam, and Eindhoven, driving salaries up without actually increasing the total supply of talent.

A pragmatic, physical constraint often overlooked in economic analyses is the Dutch housing crisis. Rents in Amsterdam and major Dutch cities have inflated to levels where even well-paid junior to mid-level developers struggle to find accommodation. This physical bottleneck limits the ability of Dutch companies to import talent, regardless of their willingness to pay high salaries. If a developer cannot find a flat, they cannot take the job. Consequently, Dutch firms are looking outward not just for cost savings, but for the sheer ability to scale teams without the logistical friction of relocating staff to a housing-constrained market. This makes the remote or nearshore model, where the developer remains in a location with housing availability (like Sofia), the only viable option for rapid scaling.

3. France, The Cost of "Reindustrialisation"

Under the "France 2030" investment plan, the French government has aggressively pushed for the "reindustrialisation" of the country through digital transformation and the growth of the French Tech ecosystem. This ambition, however, has collided with a severe skills shortage, particularly in the strategic domains of AI and Cybersecurity.

Reports indicate that France faces over 15,000 unfilled cybersecurity roles heading into 2025. In an era where digital sovereignty and data protection are paramount, this shortage represents a national security vulnerability as well as a commercial risk. While France has mobilised over 51,000 economic visas to attract talent, the administrative complexity of French bureaucracy often slows down the hiring of non-EU nationals.

The most significant hurdle for French employers, however, is the cost of employment. France is arguably the most expensive jurisdiction in Europe regarding employer social charges. For every €1 an employee takes home as net pay, a French employer spends approximately €2.41 in total employment costs. This ratio is significantly higher than in the UK or Germany and creates a heavy burden on company balance sheets.

For French CTOs, the nearshore model offers a critical release valve. It provides a way to bypass this heavy fiscal burden while accessing talent that operates in a compatible time zone. Furthermore, the historical strength of French language education in Bulgaria means that many Bulgarian professionals possess a working knowledge of French, facilitating smoother integration into Francophone teams. This cultural and linguistic affinity gives Bulgaria a distinct advantage over other nearshore destinations where English is the sole medium of communication.

4. The United Kingdom, The Post-Brexit Talent Squeeze

The United Kingdom remains the largest technology market in Europe, but it is navigating a perfect storm of regulatory, economic, and political pressures that have fundamentally altered its recruitment landscape.

The reforms to IR35 (off-payroll working rules) have acted as a massive disruptor. By shifting the risk and administrative burden of determining a contractor's employment status to the end-client, the government has inadvertently caused many banks and large enterprises to cease hiring limited company contractors altogether. This has reduced the flexibility of the UK workforce and driven up the cost of permanent hires, as contractors demand higher day rates to offset their increased tax liabilities.

Despite being a dynamic market, the UK has seen its hiring efficiency slip. New research reveals that the average time-to-fill a role in the UK is 40 days, lagging behind the US and Australia. Furthermore, the interview-to-offer ratio is startlingly low, with only 1.1% of applicants receiving an offer. This suggests a profound mismatch between the skills available in the market and the requirements of employers. In the financial services sector, attrition remains a major issue, with companies engaging in a "salary war" to poach staff from competitors, driving up costs without increasing productivity.

Adding to the cost pressure is the upcoming fiscal shift. The UK employer National Insurance rate is set to rise to 15% in April 2025, with the secondary threshold lowered to £5,000. This is effectively a direct tax on jobs, increasing the overhead for every UK-based employee. For CFOs looking to optimise Operational Expenditure (OpEx), this tax hike makes the value proposition of nearshore talent even more compelling. By shifting roles to a nearshore partner, UK companies can mitigate these rising domestic employment costs while maintaining high-quality output.

Part II: IT Recruitment in Bulgaria, The Nearshore Centre of Excellence

Why are organisations in these four nations converging specifically on IT recruitment in Bulgaria? The answer lies in a unique convergence of educational heritage, fiscal policy, and cultural alignment. Bulgaria has graduated from being a "low-cost alternative" to becoming a mature technology hub that functions as an extension of the Western European digital ecosystem.

1. The Educational Foundation, A Legacy of STEM

Bulgaria’s reputation as the "Silicon Valley of Southeastern Europe" is not a marketing slogan; it is rooted in a deep historical emphasis on mathematics and engineering. During the mid-20th century, Bulgaria was designated as the primary hub for computer manufacturing and robotics within the Eastern Bloc. This legacy has left an indelible mark on the educational system, which continues to prioritise rigorous training in mathematics and informatics from an early age.

The country boasts a robust university pipeline, producing over 2,000 graduates in tech-related fields annually from prestigious institutions like Sofia University and the Technical University of Sofia. These are not just generalist developers; the ecosystem is churning out specialists in complex, high-demand fields such as AI, Machine Learning, and Cybersecurity, precisely the profiles that Western Europe lacks. The curriculum in these universities is often aligned with industry needs, ensuring that graduates enter the workforce with practical, applicable skills.

Furthermore, English proficiency in Bulgaria is exceptionally high. The country ranks 18th in Europe and is classified as "Very High" on the EF English Proficiency Index. Unlike some Asian offshore destinations where communication nuances can be lost, Bulgarian professionals typically possess a strong command of technical and business English. The prevalence of German and French language skills (historically strong in Bulgarian secondary education) makes the country uniquely suited for DACH and Francophone clients, offering a linguistic versatility that is rare in other regions.

2. The Economic & Fiscal Advantage, The Power of the Flat Tax

For CFOs in London, Frankfurt, or Paris, the most compelling argument for Bulgaria is its fiscal stability and efficiency. The country’s tax regime is a beacon of simplicity in a complex European landscape.

Bulgaria maintains a flat 10% Corporate Income Tax (CIT) rate and a flat 10% Personal Income Tax (PIT) rate. This is the lowest flat tax rate in the European Union. When comparing the total cost of ownership (TCO) of an engineer, the difference is staggering. A senior developer salary of €75,000 in Germany costs the employer over €95,000 once social charges are added. In contrast, a senior developer salary of €50,000 in Bulgaria (which provides an exceptionally high standard of living in Sofia) carries significantly lower social security caps. The total employer cost is often 40-50% lower than in Western Europe for equivalent technical seniority.

Beyond the tax rate, currency stability is a critical factor. The Bulgarian Lev (BGN) has been pegged to the Euro for decades (and to the Deutsche Mark before that). With the country on a clear path to Eurozone adoption slated for 2026, currency risk is effectively non-existent for Euro-denominated contracts. This stability allows financial directors to forecast costs with precision, avoiding the hedging strategies often required when dealing with volatile emerging market currencies.

3. Cultural and Operational Alignment

Data from SmartChoice International emphasises that successful IT recruitment is rarely about code alone; it is about culture. The cultural alignment between Bulgaria and Western Europe is a significant accelerator of project success.

Bulgaria operates on Eastern European Time (GMT+2), which puts it 2 hours ahead of the UK and 1 hour ahead of Germany and France. This allows for nearly complete working day overlap. Agile ceremonies, daily stand-ups, and urgent bug fixes happen in real-time. There is no "overnight" wait for a response, and teams can collaborate synchronously.

The professional mindset in Sofia mirrors that of Western Europe. Bulgarian developers are known for being direct, deadline-oriented, and willing to push back on technical specifications if they see a better architectural solution. This "consultative" mindset differs from the "order-taker" mentality often found in traditional offshore low-cost centres. Western clients report that Bulgarian teams often take ownership of the product, contributing to design and strategy rather than just executing tickets.

Finally, compliance is a non-negotiable factor. As an EU member since 2007, Bulgaria adheres to GDPR and EU intellectual property protections. For a German bank or a French healthcare provider, this is critical. Data sovereignty and legal recourse are guaranteed under European law, eliminating the compliance headaches and legal risks associated with non-EU offshoring.

Part III: Data Visualisation & Market Insights

To better illustrate the comparative advantages, we have synthesised data from recent salary guides, Eurostat, and recruitment metrics into clear comparisons.

Table 1: Comparative Employer Costs for a Senior Software Engineer (2025 Estimate)

Comparison of the Total Cost to Company (Salary + Taxes + Social Security) for a Senior Java Developer.

Country | Base Salary (Avg) | Employer Social Charges (Approx) | Total Cost to Employer | Cost Saving vs UK |

UK | £75,000 (€88,500) | 15% NI + Pension (~£13k) | ~£88,000 (€103,800) | - |

Germany | €78,000 | ~21% (~€16k) | ~€94,000 | +10% more expensive |

Netherlands | €75,000 | ~20-25% (~€17k) | ~€92,000 | +12% more expensive |

France | €65,000 | ~45% (~€29k) | ~€94,000 | +7% more expensive |

Bulgaria | €55,000 | ~19% (Capped ~€3k) | ~€58,000 | ~44% Savings |

(Note: Exchange rates and tax caps are estimates based on 2025 fiscal policies. Bulgaria’s social security is capped on a maximum insurable income, significantly reducing the effective rate for high earners.)

Table 2: Time-to-Hire Velocity

Median days to fill a senior technical role.

Market | Time-to-Hire (Days) | Status |

Germany | 55+ days | Critical Delay |

UK | 40 days | Sluggish |

France | 39 days | Slow |

Bulgaria (SmartChoice) | 14-28 days | Optimised |

Insight: The SmartChoice network in Bulgaria allows for a 50% reduction in hiring time compared to the German average. This velocity is achieved through proactive headhunting rather than reactive job posting.

Part IV: The Role of SmartChoice International

The SmartChoice Engagement Framework

SmartChoice does not operate as a transactional agency; it operates as a strategic consultancy. Our methodology is distinct in its structure, designed to eliminate the friction typically associated with cross-border hiring:

Strategic Alignment & Discovery: The process avoids the common "keyword matching" trap. Instead of simply looking for "Java Developers," SmartChoice consultants analyse the client's technical roadmap. They ask probing questions: Is this a maintenance project or a greenfield build? Do you need a "pioneer" mentality or a "settler" mentality? This ensures the architects and developers selected fit the context of the project, not just the job description.

Targeted Headhunting: SmartChoice relies on active headhunting rather than passive advertising. In a mature market like Sofia, the best talent is passive; they are already employed, well-paid, and not scrolling through job boards. SmartChoice’s recruiters tap into deep local networks to extract these high-performers, particularly in niche stacks like ServiceNow and Cybersecurity.

Easy Integration: SmartChoice manages the "boring but critical" infrastructure: employment contracts, local taxation, equipment procurement, and compliance. This allows the UK or German client to treat the remote team member as a plug-and-play resource, avoiding the administrative burden of international employment law.

Specialisation: ServiceNow & AI

A key differentiator for SmartChoice is its deep specialisation in ServiceNow. As ServiceNow integrates Generative AI (GenAI) via its Yokohama release, the demand for developers who understand both the platform and AI agents has spiked globally. SmartChoice has anticipated this trend, building specific talent pools in Bulgaria focused on:

IT Service Management (ITSM): Configuring workflows to align with ITIL standards.

IT Operations Management (ITOM): Ensuring visibility and health of infrastructure.

AI Agent Studio: Recruiting developers capable of building and deploying low-code AI agents.

This foresight allows SmartChoice to supply talent for roles that Western agencies struggle to fill, such as "AI Solution Architects" for Fintechs. While generalist agencies scramble to find resumes, SmartChoice has nurtured a community of specialists ready to deploy.

Part V: Client Story: "Project Velocity"

To illustrate the tangible impact of this model, we present a detailed case study of a UK-based client. For confidentiality, we will refer to them as "BritFin Solutions", a London-based financial services provider facing a critical regulatory deadline.

The Client: BritFin Solutions (London, UK)

Sector: Financial Services / Fintech.

The Challenge: BritFin was undergoing a massive digital transformation driven by new Financial Conduct Authority (FCA) compliance regulations and a concurrent need to automate legacy customer service workflows using ServiceNow.

The Problem: The London talent market was overheated.

Cost: Daily rates for ServiceNow architects in London were exceeding £850/day.

Availability: The time-to-hire for permanent staff was averaging 4 months.

Attrition: BritFin’s internal team was suffering from 25% attrition as competitors poached staff with inflated salary offers.

Risk: The FCA deadline was immovable. Missing it would result in significant fines and reputational damage.

The SmartChoice Solution: A Hybrid Nearshore Model

BritFin engaged SmartChoice International not just to fill vacancies, but to design a resilient delivery capability. SmartChoice proposed a Hybrid Nearshore Model:

Onshore Leadership: One Lead Architect placed in London to interface directly with BritFin’s C-suite and handle sensitive stakeholder management.

Nearshore Delivery Pod: A dedicated team of 5 Senior ServiceNow Developers and 2 QA Automation Engineers based in Sofia, Bulgaria.

Implementation

Week 1-2 (Discovery): SmartChoice consultants sat with BritFin’s CTO to map the technical debt and define the exact profile of the "Sofia Pod." They established that the team needed specific experience in the Financial Services Operations module of ServiceNow—a niche within a niche.

Week 3-5 (Headhunting): Using their local Bulgarian network, SmartChoice identified candidates who had previously worked on similar compliance projects for German and Swiss banks (a common profile in Bulgaria given the outsourcing history).

Week 6 (Deployment): The team was interviewed, selected, and onboarded. SmartChoice handled all local compliance, providing the team with secure, compliant hardware to meet BritFin’s data security standards.

The Results

Cost Savings: The total cost of the 7-person Bulgarian team was 40% lower than the projected cost of an equivalent London-based team. BritFin saved approximately £350,000 in the first year alone on salaries and overheads.

Speed to Delivery: The team was fully operational in 6 weeks, compared to the estimated 4-5 months for London hires. This velocity allowed BritFin to meet the FCA compliance deadline with time to spare.

Quality & Retention: The Bulgarian team delivered code with a 99% acceptance rate during UAT (User Acceptance Testing). Critically, retention was 100% over the 18-month project duration. The stability of the team meant institutional knowledge was retained, unlike the revolving door of the London office.

Innovation: The Bulgarian developers proactively suggested using ServiceNow’s new AI Agent capabilities to automate 30% of the manual compliance checks—a value-add that BritFin hadn’t originally scoped but which significantly reduced their operational risk.

Client Testimonial:

We were sceptical about nearshoring for such a sensitive regulatory project. SmartChoice built us a high-performance engine. The team in Sofia are the core of our engineering capability. Their technical rigour is unmatched, and they operate as if they are in the office next door.

— CTO, BritFin Solutions (Composite based on client sentiment)

Part VI: Outlook for 2026

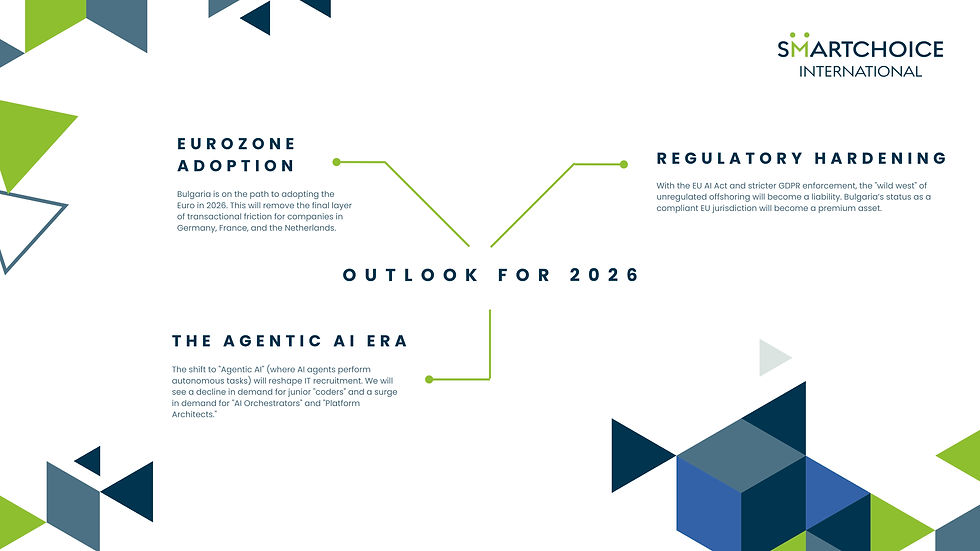

As we look toward 2026, several factors will further cement Bulgaria’s position as the premier nearshore destination.

1. Eurozone Adoption (2026)

Bulgaria is on the path to adopting the Euro in 2026. This will remove the final layer of transactional friction for companies in Germany, France, and the Netherlands. It will simplify payroll, eliminate exchange rate hedging, and further integrate the Bulgarian economy into the Western European core. This monetary integration sends a powerful signal of stability to international investors.

2. The Agentic AI Era

The shift to "Agentic AI" (where AI agents perform autonomous tasks) will reshape IT recruitment. We will see a decline in demand for junior "coders" and a surge in demand for "AI Orchestrators" and "Platform Architects." Bulgaria’s STEM-heavy education system is perfectly positioned to pivot to this high-complexity work, whereas volume-based markets may struggle to upskill fast enough. SmartChoice is already preparing for this shift by building pipelines for AI-native developers.

3. Regulatory Hardening

With the EU AI Act and stricter GDPR enforcement, the "wild west" of unregulated offshoring will become a liability. Bulgaria’s status as a compliant EU jurisdiction will become a premium asset. Western companies will increasingly pay a premium for the peace of mind that comes with EU legal frameworks, pushing more work away from non-compliant jurisdictions and into the safety of the EU nearshore.

Conclusion: The Smart Choice for the Decade Ahead

The converging pressures of the 2020s (talent scarcity, fiscal tightening, and technological acceleration, etc.) have rendered traditional recruitment models obsolete. For organisations in Germany, the Netherlands, France, and the UK, waiting for local talent markets to correct is not a strategy; it is a risk.

Bulgaria represents the optimal solution to this equation. It offers the technical depth of a mature market, the fiscal efficiency of an emerging economy, and the cultural proximity of a European neighbour. It is a market where innovation meets stability.

Organisations like SmartChoice International are the catalysts in this ecosystem. By providing the governance, the network, and the strategic oversight, they allow Western enterprises to access this talent pool not as a compromise, but as a competitive advantage.

For the forward-thinking CTO, the question is no longer "Why Bulgaria?" The question is "How fast can we start?"

Actionable Recommendations for Employers:

Audit Your "Core" vs "Context": Identify which roles truly require physical presence in London or Berlin. Move the high-complexity, digital-native roles (ServiceNow, Cloud Ops) to a nearshore pod in Sofia.

Partner for "Pods", Not "Placements": Move away from hiring individual contractors. Work with SmartChoice to build a cohesive "Agile Pod" that retains knowledge and culture within your organisation.

Use the Tax Advantage: Use the cost savings from the Bulgarian 10% tax regime to reinvest in higher salaries for the nearshore team, securing the top 1% of talent while still saving 40% overall compared to Western Europe.

Prepare for Euro adoption: Start structuring contracts now to transition seamlessly to Euro-based payments in 2026, simplifying long-term financial planning.

Sources:

Job vacancy statistics - Statistics Explained - Eurostat, accessed on December 22, 2025, https://ec.europa.eu/eurostat/statistics-explained/index.php/Job_vacancy_statistics

The 30% ruling for your foreign employees in the Netherlands, accessed on December 22, 2025, https://business.gov.nl/staff/employing-staff/the-expat-scheme-30-percent-ruling-in-the-netherlands/

30% facility for highly educated foreign employees (expats), accessed on December 22, 2025, https://www.government.nl/topics/income-tax/shortening-30-percent-ruling

Why young people are the big losers in Europe’s dysfunctional housing system, accessed on December 22, 2025, https://www.theguardian.com/world/2025/dec/17/this-is-europe-young-people-dysfunctional-housing-system-renting

UK Hiring Times Among Slowest Globally, New Research Finds, accessed on December 22, 2025, https://diversitydashboard.co.uk/news/uk-hiring-times-among-slowest-globally-new-resear/801/

Rates and thresholds for employers 2025 to 2026 - GOV.UK, accessed on December 22, 2025, https://www.gov.uk/guidance/rates-and-thresholds-for-employers-2025-to-2026

accessed on December 22, 2025, https://www.xero.com/uk/guides/national-insurance-changes-2025/

EF EPI | EF English Proficiency Index | EF Global Site (English), accessed on December 22, 2025, https://www.ef.com/wwen/epi/

Bulgaria corporate tax - guide for international expansion - Wise, accessed on December 22, 2025, https://wise.com/gb/blog/bulgaria-corporate-tax

Understanding Bulgaria's tax rate - No More Tax, accessed on December 22, 2025, https://nomoretax.eu/bulgaria-tax-rate/

How Much Do Developers Actually Make in Bulgaria? 2025 Salary ..., accessed on December 22, 2025, https://www.nextjob.bg/how-much-do-developers-actually-make-in-bulgaria/

Comments